How to calculate lot size in forex 2026 : Starting Forex trading without knowing lot size is like driving a car blindfolded. You might go fast, but you won’t know when you’re about to crash. How to calculate lot size in forex 2026: Lot size is the foundation of risk management. It determines how much money you stand to gain or lose on a trade, and it’s something even experienced traders constantly check before opening a position.

Trading without calculating lot size is one of the fastest ways to lose your account. On the other hand, mastering lot size calculation can turn you into a disciplined, confident trader.

How to calculate lot size in forex 2026

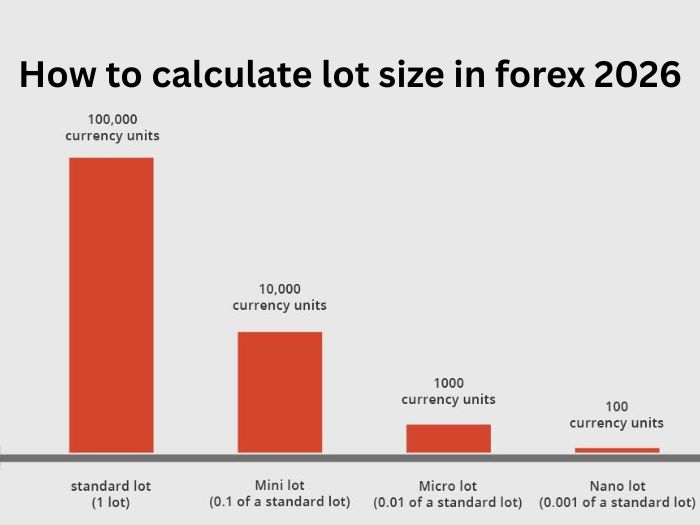

A lot in Forex is a standardized quantity of currency units. Imagine you’re buying apples:

- A standard lot is like buying a full crate of 100,000 apples.

- A mini lot is a smaller basket of 10,000 apples.

- A micro lot is a small bag of 1,000 apples.

- A nano lot is a handful of 100 apples.

This standardization makes risk calculation easier and allows brokers to manage trades efficiently.

Introduction to Forex Lot Size in 2026: Impacts Your Trading Risk

Lot size affects:

- Profit potential – Bigger lots = bigger profits per pip.

- Loss potential – Bigger lots = bigger losses per pip.

- Margin requirement – Larger lots require more margin in your account.

For example: if you trade 1 standard lot of EUR/USD, each pip movement equals $10. Trade 0.1 mini lot, and each pip equals $1.

In other words, lot size is the lever controlling your risk and reward.

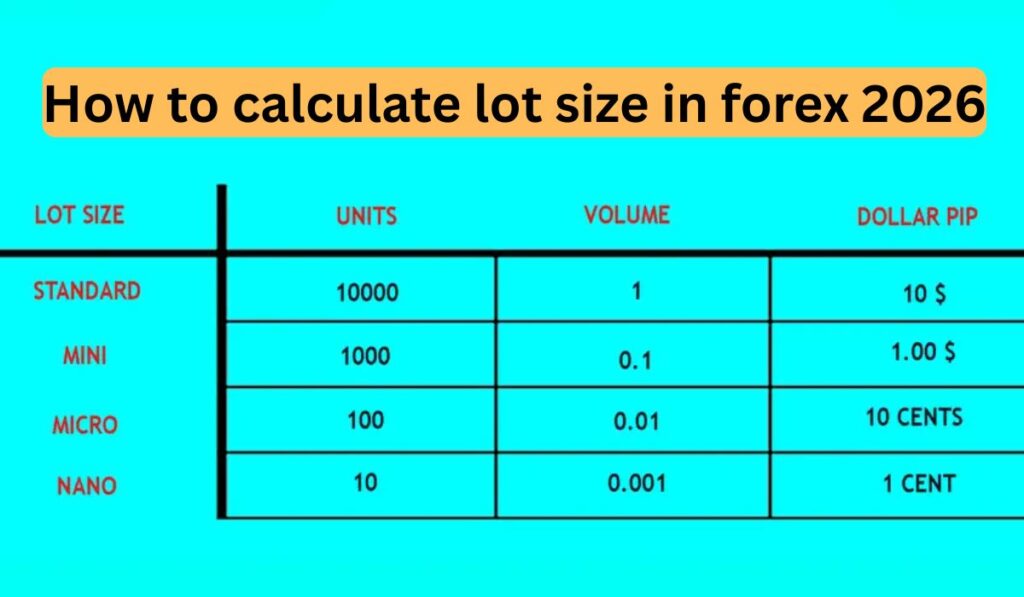

Different Types of Forex Lots

Understanding the different lot types helps beginners choose the right one for their account size and strategy.

Standard Lot

- 100,000 units of the base currency

- Suitable for experienced traders

- High profit and loss potential

Mini Lot

- 10,000 units

- Beginner-friendly

- Lower risk per trade

Micro Lot

- 1,000 units

- Great for testing strategies

- Ideal for small accounts

Nano Lot

- 100 units

- Available with few brokers

- Extremely low risk, perfect for absolute beginners

Key Factors to Consider Before Calculating Lot Size

Account Balance

Your account size sets the foundation. Don’t trade a standard lot on a $500 account — you’ll blow it in one trade.

Risk Tolerance

Your comfort level matters. If you panic when losing $10, risk only 1% or less per trade.

Stop Loss & Take Profit

Your stop loss protects your account. If your stop loss is 50 pips and your account balance is $1,000, lot size must be adjusted so you don’t risk more than your limit.

Step-by-Step Lot Size Calculation

Let’s do a practical example to make it crystal clear.

Step 1: Decide Your Risk Percentage

Most professional traders risk 1–3% of their account per trade. Example:

Read this also – What Is Margin in Forex 2026

- Account balance = $1,000

- Risk = 2% → Risk per trade = $20

Step 2: Determine Stop Loss in Pips

Check your trade setup and see where your stop loss should be. Let’s say 50 pips.

Step 3: Apply the Lot Size Formula

Lot Size Formula:

\text{Lot Size} = \frac{\text{Account Balance} \times \text{Risk %}}{\text{Stop Loss in Pips} \times \text{Value per Pip}}

Example for a mini lot:

Lot Size=1000×0.0250×1=0.4 mini lotsLot Size=50×11000×0.02=0.4 mini lots

So, you would trade 0.4 mini lots to risk $20 with a 50-pip stop loss.

Step 4: Enter Lot Size on Your Trading Platform

Most platforms like MetaTrader 4/5 allow you to enter the lot size manually when placing a trade. Always double-check to ensure you are risking only what you intended.

Real-Life Example for Beginners

Suppose you want to trade GBP/USD with a $1,500 account. You risk 2% and your stop loss is 30 pips.

- Risk per trade = $1,500 × 0.02 = $30

- Lot Size = $30 ÷ (30 × $1) = 1 mini lot

You place 1 mini lot; if GBP/USD moves 30 pips against you, you lose $30 — exactly what you planned.

Read this also – Exxon Mobil Corporation Shares price 2026

This shows how lot size calculation protects your account and keeps losses manageable.

Using Forex Calculators

Benefits of Using a Lot Size Calculator

- Saves time

- Reduces mistakes

- Quickly adjusts for currency pair differences

How to Use It Effectively

- Enter account balance

- Choose risk percentage

- Input stop loss

- Select currency pair

- Calculator outputs recommended lot size

Best Online Forex Lot Calculators

- BabyPips Forex Calculator

- Myfxbook Position Size Calculator

- OANDA Forex Calculator

These are beginner-friendly and provide accurate calculations instantly.

Common Mistakes Traders Make

Over-Leveraging

Trading bigger lots than your account allows can wipe out your funds in seconds. Always calculate leverage carefully.

Ignoring Risk Management

Some traders skip lot size calculation entirely. This is like playing Russian roulette with your account. Always calculate first.

Read this also –Is Forex Trading Legal in Dubai 2026

Trading Emotionally Without Lot Size Planning

Fear and greed can lead to overtrading. Pre-calculated lot sizes keep your emotions in check.

Tips to Manage Lot Size Like a Pro

Adjust Lot Size Based on Market Conditions

- High volatility = smaller lot size

- Low volatility = slightly larger lot size

Stick to Calculated Lot Sizes for Discipline

Read this also- What Is Liquidity in Forex 2026

Treat lot size like a budget. Stick to it consistently to survive long-term.

Combine Lot Size With Trading Strategies

Some strategies work better with smaller lots, like scalping. Swing trading may allow slightly bigger lots. Adapt to your plan.

Advanced Insights for Intermediate Traders

Scaling In and Scaling Out Positions

Advanced traders often enter in smaller lots and add as the trade moves in their favor. This controls risk while maximizing profits.

Hedging with Different Lot Sizes

Hedging using multiple lots can offset potential losses. Calculating exact lot sizes for hedges is key to balance risk.

Using Lot Size With Leverage Carefully

Leverage amplifies both gains and losses. Even with calculated lot sizes, high leverage can be dangerous. Use responsibly.

Conclusion

Calculating lot size in Forex is not optional — it’s a critical skill for every trader. By understanding lot types, your risk tolerance, and following a step-by-step calculation, you can manage losses, maximize profits, and trade with confidence. Beginners should start with micro lots, gradually moving to mini and standard lots as experience grows. Discipline in lot size management separates successful traders from beginners who lose fast.

Remember: smart trading is about controlling losses, not chasing profits.

FAQs

Q1: What is the safest lot size for beginners?

A: Micro lots (1,000 units) allow trading with minimal risk.

Q2: How much should I risk per trade?

A: Typically, 1–3% of your account per trade is recommended.

Q3: Can I trade Forex without calculating lot size?

A: Yes, but it’s extremely risky and may wipe your account.

Q4: What happens if I trade with bigger lots than planned?

A: Potential profits increase, but losses grow even faster.

Q5: Are Forex calculators reliable?

A: Yes, if accurate trade details are entered. They are great tools for beginners and intermediates.