What Is Margin in Forex 2026 : If you’ve just started learning forex, margin probably feels confusing, risky, and a little scary. Some people say margin is dangerous. What Is Margin in Forex 2026 : Others say it’s the secret to big profits. So what’s the truth?

The truth is simple: margin is neither good nor bad. It’s just a tool. And like any tool, it depends on how you use it.

In this guide, I’ll explain margin in a human, no-fluff way, like one trader talking to another over coffee. No robotic definitions. No copy-paste theory. Plain Just real explanations, practical examples, and honest advice.

What Is Margin in Forex 2026- Simple Explanation

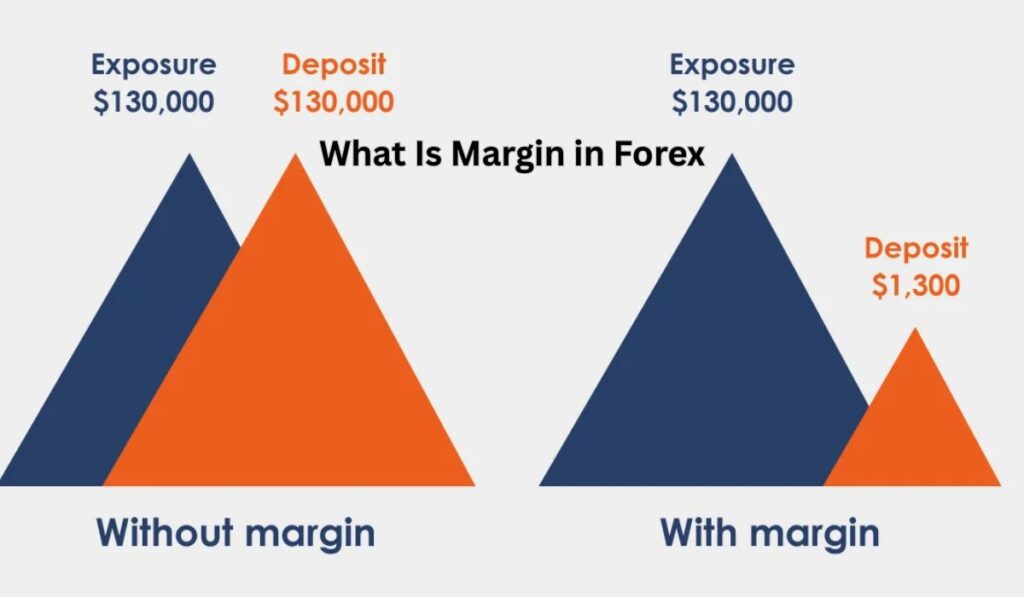

Margin in forex is the money your broker sets aside from your account to keep a trade open.

That’s it.

- It’s not a fee

- It’s not a cost

- It’s not lost money

Think of margin like a security deposit. When you open a trade, your broker temporarily locks some money. When the trade closes, that money is released back to you (plus profit or minus loss).

Why Margin Exists in Forex Trading

What Is Margin in Forex 2026: Forex trading involves very large amounts of money. Currencies move in tiny price changes, so traders need size to make meaningful profits.

Margin exists so:

- Small traders can access big markets

- You don’t need $100,000 to trade $100,000

- The market stays liquid and active

Without margin, forex trading would be limited to banks and institutions only.

Margin vs Leverage -This Confuses Everyone

Let’s clear this up once and for all.

- Margin = Your money

- Leverage = Broker’s support

If margin is the fuel, leverage is the engine.

Example:

- Leverage: 1:100

- Trade size: $100,000

- Margin required: $1,000

Higher leverage = lower margin required

Lower leverage = higher margin required

Simple.

How Margin Works in Real Trading Step-by-Step

Let’s walk through a realistic example.

You have:

- Account balance: $2,000

- Leverage: 1:100

- You open a 0.5 lot trade (50,000 units)

Margin required:

50,000 ÷ 100 = $500

So:

- $500 is locked as margin

- $1,500 remains as free margin

- You can still handle price movement safely

This is healthy margin usage.

A Real-Life Analogy to Understand Margin

Imagine you’re renting a bike.

- Rental cost = Profit/Loss

- Security deposit = Margin

- Bike value = Trade size

You don’t buy the bike. You just deposit some money to use it. When you return it, you get your deposit back.

Forex margin works the same way.

Different Types of Margin You Must Understand

If you ignore these, you’ll blow accounts. Period.

1. Required Margin

The minimum amount needed to open a trade.

2. Used Margin

Total margin currently locked in open trades.

Read this also – Is Forex Trading Legal in Dubai 2026

3. Free Margin

Money available to open new trades.

Free Margin = Equity – Used Margin

4. Equity

Your real account value:

Balance + floating profit/loss

Equity is what really matters.

What Is Margin Level- Very Important

Margin level shows how safe your account is–

Formula:

Margin Level = (Equity ÷ Used Margin) × 100

- 500% → Very safe

- 200% → Caution

- 100% → Margin call danger

- Below broker limit → Stop out

Always watch your margin level like a hawk.

What Is a Margin Call- Don’t Ignore This

A margin call happens when your equity drops too low compared to used margin.

Your broker is basically saying:

“Hey, your account is in danger. Do something.”

Read this also –What Is Liquidity in Forex 2026

You have three options:

- Add funds

- Close losing trades

- Reduce position size

Ignoring margin calls is how traders lose everything.

What Is Stop Out?

If you don’t act after a margin call, the broker will.

Stop out means the broker automatically closes trades to protect itself.

You lose control.

Trades close at the worst possible time.

Account damage is real.

This is why margin discipline matters.

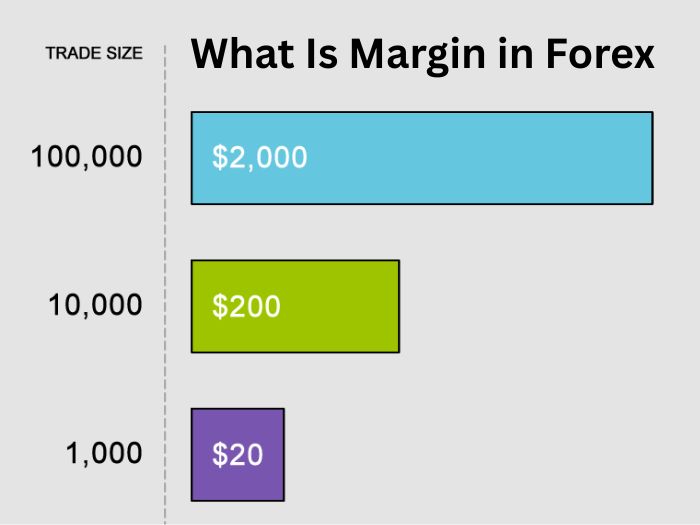

How to Calculate Margin in Forex No Headache Math

Basic formula:

Margin = (Lot Size × Contract Size) ÷ Leverage

Common lot sizes:

- 1.00 lot = 100,000 units

- 0.10 lot = 10,000 units

- 0.01 lot = 1,000 units

Smaller lots = lower margin = safer trading.

Read this also- How to Trade Forex in India 2026 -Full Guide

Margin Requirements for Different Currency Pairs

Not all pairs are equal.

- Major pairs (EUR/USD, GBP/USD)

→ Lower margin, stable movement - Minor pairs

→ Medium margin - Exotic pairs

→ High margin, high volatility

Beginners should avoid exotic pairs completely.

Is Margin Trading Risky?

Margin itself is not risky.

Poor behavior is risky.

Advantages of Margin

- Trade larger positions

- Better capital efficiency

- More flexibility

Disadvantages

- Faster losses

- Emotional pressure

- Overtrading temptation

Margin magnifies both discipline and mistakes.

Best Margin Management Tips- Real Trader Advice

If you remember nothing else, remember this.

Golden Rules

- Never use full margin

- Risk only 1–2% per trade

- Keep margin level above 300%

- Always use stop-loss

Smart Habits

- Trade micro lots first

- Avoid news trading as beginner

- Don’t open multiple trades blindly

Margin rewards patience, not greed.

Common Margin Mistakes That Kill Accounts

Let’s be blunt.

Most traders fail because they:

- Use too much leverage

- Ignore margin level

- Trade emotionally

- Chase losses

- Open oversized positions

Margin exposes bad habits fast.

Margin in Forex vs Margin in Stock Trading

| Feature | Forex | Stocks |

| Leverage | Very high | Low |

| Margin Calls | Frequent | Rare |

| Risk Speed | Fast | Slow |

Forex margin is powerful — but unforgiving.

Is Margin Trading Good for Beginners?

Yes — if used correctly.

Beginners should:

- Start with demo accounts

- Use 0.01 lot size

- Choose low leverage

- Focus on learning, not money

Margin is a teacher. A strict one.

Final Thoughts: Respect Margin, Survive Forex

Margin isn’t your enemy. Ignorance is.

Once you understand how margin works, how leverage affects it, and how to manage risk, forex becomes calmer, smarter, and more controlled.

Trade small.

Stay patient.

Respect margin.

That’s how real traders last.

FAQs

1. What exactly is margin in forex?

Margin is the money set aside to open and maintain a trade.

2. Do I lose margin money?

No, unless your trade loses money.

3. Is high leverage better?

No. High leverage increases risk, especially for beginners.

4. What is a safe margin level?

Above 300% is generally considered safe.

5. Can margin wipe my account?

Yes, if misused. Proper risk control prevents this.