What is non farm payroll forex 2026: If you’ve ever opened a forex chart on the first Friday of the month and thought, “Why is the market going crazy today?”—Welcome to the world of Non Farm Payroll, or simply NFP. What is non farm payroll forex 2026: For some traders, NFP is exciting. For others, it’s terrifying. And for beginners, it often feels like a mystery wrapped in numbers, news, and sudden price spikes. Let’s fix that.

In this article, I’ll explain what Non Farm Payroll is in forex, why it matters so much, how it actually moves the market, and how you should (or shouldn’t) trade it—in simple, human language. No textbook talk. No boring theory. Just practical understanding.

So, What Exactly Is Non Farm Payroll 2026?

Let’s keep it simple.

Non Farm Payroll (NFP) is a monthly report that shows how many new jobs were created or lost in the United States, excluding farm workers.

That’s it.

It’s released by the U.S. Bureau of Labor Statistics (BLS) and is considered one of the most important economic indicators in the world.

Why? Because jobs = income, income = spending, spending = economic growth.

And economic growth directly impacts currency value—especially the US dollar.

What is non farm payroll forex 2026”? The Logic Behind the Name That Confuses Most Traders

Farm jobs are highly seasonal. One month you might need thousands of workers, the next month almost none. Weather, harvest cycles, and temporary labor can distort the data.

To keep things clean and reliable, farm jobs are excluded. Along with:

- Self-employed individuals

- Private household workers

- Non-profit organization employees

What’s left gives a clear picture of real economic activity.

Why Forex Traders Care So Much About NFP

Here’s the big reason:

The US dollar is involved in nearly 90% of all forex trades.

So when data comes out that directly reflects the health of the US economy, the entire forex market pays attention.

A strong NFP report can:

- Push the USD sharply higher

- Crash EUR/USD and GBP/USD

- Drop gold prices

- Move indices like the S&P 500

A weak NFP can do the opposite.

This is why NFP days are marked in red on economic calendars.

What Information Does the NFP Report Actually Contain?

Many traders only look at the headline number. That’s a mistake.

The NFP report is more like a combo meal, not a single dish.

1. Employment Change (The Headline Number)

This shows how many jobs were added or lost in the previous month.

Example:

- Forecast: +180,000

- Actual: +250,000

That’s a strong surprise → usually bullish for USD.

But wait—don’t trade yet.

2. Unemployment Rate

This tells you what percentage of people are unemployed but actively looking for work.

- Falling unemployment = economic strength

- Rising unemployment = possible slowdown

Sometimes, jobs increase but unemployment also rises. That’s where confusion—and volatility—comes in.

3. Average Hourly Earnings (Wages)

This is huge.

Why? Because rising wages can lead to inflation. And inflation influences interest rates. And interest rates move currencies.

Sometimes NFP jobs are okay, but wages jump—and the market still goes wild.

4. Revisions to Previous Months

Sneaky but important.

Last month’s data often gets revised. A strong current report with negative revisions can reduce bullish impact—and vice versa.

Pros always check this. Beginners usually don’t.

When Is NFP Released-Timing Matters

Non Farm Payroll is released on the first Friday of every month.

The exact time:

- 8:30 AM New York (EST)

- 1:30 PM London (GMT)

- 6:00 PM India (IST)

Within seconds of the release, price can move 50–200 pips in major pairs.

No exaggeration.

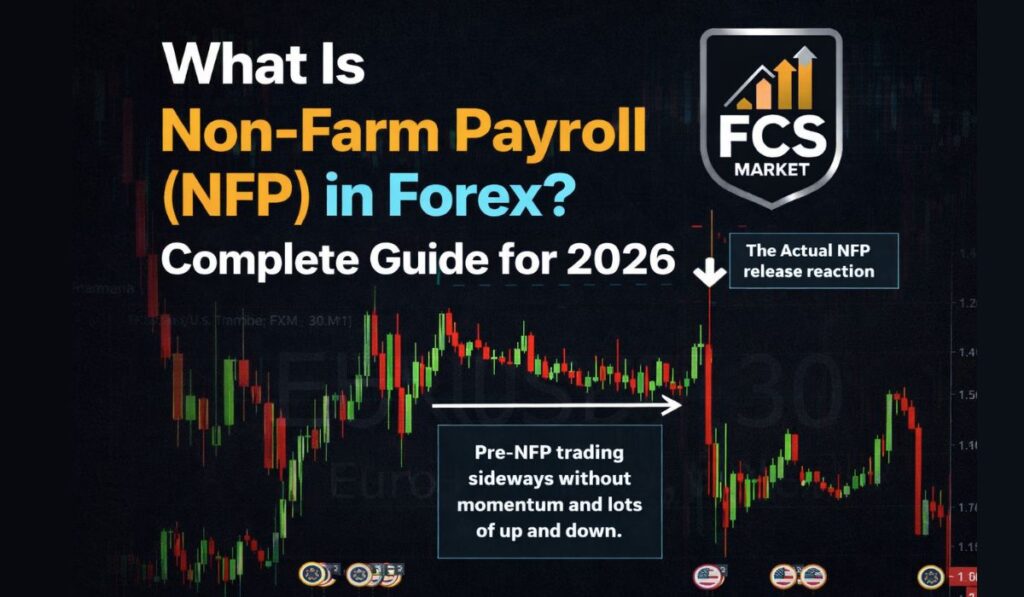

How NFP Actually Moves the Forex Market

Here’s the key idea most beginners miss:

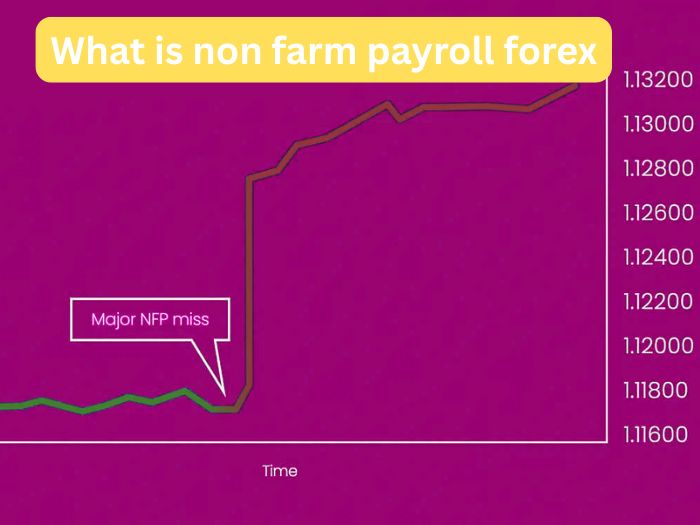

The market doesn’t move on the number—it moves on the surprise.

If everyone expects 200K jobs and the result is 205K, the move may be small.

But if the result is 320K or 80K? Boom

That gap between expectation and reality is what creates volatility.

Which Forex Pairs Are Most Affected by NFP?

Any pair involving the US dollar can move, but some are favorites:

- EUR/USD – the king of liquidity

- GBP/USD – fast and aggressive moves

- USD/JPY – clean directional reactions

- XAU/USD (Gold) – extremely popular during NFP

Gold especially can feel like a rollercoaster on NFP day.

Why NFP Is So Dangerous for Beginners

Let’s be honest.

NFP is not dangerous because of the news—it’s dangerous because of how traders behave.

During NFP:

- Spreads widen

- Slippage increases

- Stop losses don’t always fill where you expect

- Emotions go out the window

One bad decision with high leverage can wipe weeks—or months—of profits.

That’s why many professional traders don’t trade the release at all.

Yes, really.

Different Ways Traders Approach NFP

There’s no single “correct” way. But there are smarter and riskier approaches.

Read this also – What Is Margin in Forex 2026

Trading Before NFP

Some traders position themselves hours or days before NFP based on forecasts and technical setups.

This can work—but if the data surprises, you’re on the wrong side instantly.

Read this also – How to calculate lot size in forex 2026

Trading the Exact Release (High Risk)

This is the YouTube-style trading you see online.

Buy stops, sell stops, fast execution.

It can pay big—or fail brutally. Not beginner-friendly.

Trading After NFP (Smart Money Approach)

Many experienced traders wait 15–30 minutes after the release.

They let volatility settle, spreads normalize, and then trade the real direction.

Read this also –What Is Forex Markup 2026

This approach:

- Reduces risk

- Avoids fake spikes

- Works better for beginners

Simple NFP Trading Strategies

Let’s talk practical.

The Wait-and-Confirm Strategy

This is the safest approach.

You wait for:

- Initial spike

- Pullback

- Clear direction

Then you enter with trend confirmation.

No rush. No gambling.

Read this also – Can We Trade Forex in Zerodha 2026

Higher Timeframe Trend Strategy

If the daily trend is bullish on USD and NFP is strong, you trade in the same direction after confirmation.

Think of NFP as fuel, not the engine.

Common Mistakes Traders Make on NFP Day

Let’s call them out:

Read this also – XAUUSD Daily Forecast Today – 1H Price Action, Key Buy & Sell Levels | FCS Market

- Overleveraging because “big move coming”

- Trading without checking spreads

- Chasing price after the first spike

- Revenge trading after a loss

- Ignoring stop-loss placement

NFP doesn’t forgive emotional trading.

Risk Management Tips for NFP Trading

If you trade NFP, follow these rules like religion:

Read this also – StubHub IPO disclosure issues 2026 – FCS Market

- Reduce lot size

- Accept slippage as normal

- Use wider stops than usual

- Never risk more than you can afford to lose

- Skip the trade if conditions feel messy

Missing a trade is better than blowing an account.

NFP vs Other Major Economic News

You might wonder how NFP compares to other events.

- CPI (Inflation): Focuses on prices

- FOMC: Focuses on interest rates

- ADP: Private employment estimate

NFP stands out because it reflects real economic activity and influences all the others.

Is NFP Trading Good for Beginners? Honestly?

Short answer: Not at first.

Read this also – Why Crypto Market Is Down Today in India

Long answer: Observe it. Study it. Trade it on demo. Learn how price reacts.

Once you understand volatility and risk, you can slowly include it in your strategy.

There’s no prize for trading every NFP.

How Professionals Read NFP Like a Story

Pros don’t just see numbers. They see context.

They ask:

- Did wages rise or fall?

- Were previous months revised?

- What does this mean for interest rates?

- Is the market already priced in?

That’s why sometimes “good news” still causes price to fall.

Read this also –Stock Market Crash Today: Key Reasons Behind the Fall

Pros and Cons of Trading NFP

Advantages

- Massive volatility

- Strong trends

- Clear fundamental catalyst

Disadvantages

- High risk

- Slippage

- Emotional pressure

It’s a double-edged sword.

Read this also – How to Start Forex Trading in 2026

Final Thoughts: Respect NFP, Don’t Fear It

Non Farm Payroll is not your enemy.

But it’s also not your lottery ticket.

If you understand what NFP is, why it matters, and how it affects the forex market, you’re already ahead of most beginners.

Trade it carefully—or don’t trade it at all. Both choices are valid.

Read this also – IEX Market Coupling Case 2026: Guide for Traders and Investors

In forex, survival always comes before profit.

FAQs About Non Farm Payroll in Forex

1. What is NFP in simple words?

NFP shows how many jobs were added or lost in the US economy each month, excluding farm jobs.

2. Why does NFP move forex so much?

Because it reflects US economic strength and directly impacts the US dollar.

3. Can I trade NFP with a small account?

It’s risky. Smaller accounts should trade reduced size or avoid the release.

4. Which market reacts most to NFP?

USD pairs and gold (XAU/USD) show the strongest reactions.

5. Is NFP better than CPI or FOMC?

All are important, but NFP is the most explosive in terms of short-term volatility.